AM Best Rating of Sagesure Insurance: Comprehensive Guide to Understanding Insurance Ratings

When it comes to choosing the right insurance company, understanding its financial stability is crucial. One of the most reliable ways to gauge this is by looking at ratings from organizations like AM Best. In this article, we’ll delve into everything you need to know about AM Best ratings and how they apply to Sagesure Insurance. We’ll break down the complex jargon into simple terms, answer common questions, and even sprinkle in a bit of humor to keep things engaging. By the end of this guide, you’ll be well-informed and ready to make the best decisions for your insurance needs.

What is AM Best?

AM Best is a global rating agency that specializes in evaluating the financial strength and creditworthiness of insurance companies. Established in 1899, AM Best has a long-standing reputation for providing accurate and reliable ratings that help consumers and businesses assess the stability and reliability of insurance providers.

Why AM Best Ratings Matter

Insurance companies need to maintain financial stability to meet their policyholder’s claims. AM Best ratings provide a snapshot of an insurer’s ability to fulfill these obligations. A high rating indicates strong financial health, while a lower rating suggests potential issues.

Imagine if your favorite ice cream shop had a “Best in Town” rating—AM Best is like that, but for insurance companies.

Understanding AM Best Ratings

AM Best uses a specific rating scale to categorize insurance companies’ financial health. Here’s a breakdown of their main ratings:

This rating reflects an insurance company’s ability to meet its ongoing insurance obligations. It’s crucial because it directly impacts the company’s reliability from a policyholder’s perspective.

Rating Scale:

- A++ (Superior): Excellent financial health and ability to meet obligations.

- A+ (Superior): Strong financial health with a good ability to meet obligations.

- A (Excellent): Solid financial health with the ability to meet obligations.

- B++ (Good): Financially stable but with more potential for risk.

- B (Fair): Moderately weak financial strength.

- C++ (Marginal): Poor financial health and questionable ability to meet obligations.

- C (Weak): Financial instability and significant risk of not meeting obligations.

- D (Poor): High risk of not being able to meet obligations.

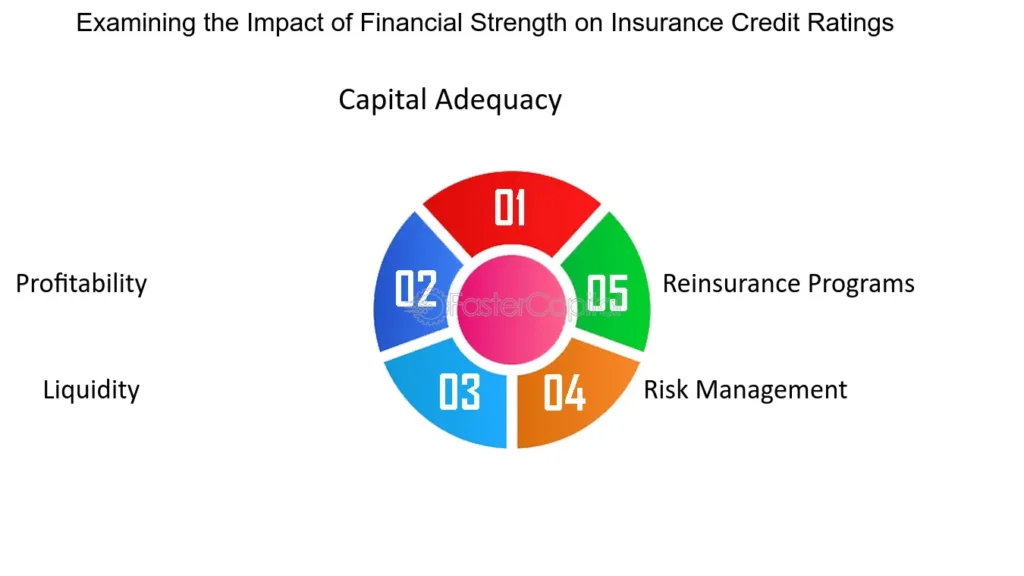

The ICR measures an insurance company’s overall creditworthiness, including its ability to repay debt. It provides insight into how well the company manages its debt and financial obligations.

Rating Scale:

- a++ (Superior): Very strong creditworthiness with low risk.

- a+ (Strong): Strong creditworthiness with low risk.

- a (Good): Good creditworthiness with moderate risk.

- b++ (Adequate): Adequate creditworthiness with some risk.

- b (Weak): Weak creditworthiness with high risk.

- c++ (Poor): Poor creditworthiness with significant risk.

- c (Very Poor): Very poor creditworthiness with high risk of default.

AM Best also provides outlooks for their ratings, indicating whether a company’s rating is likely to improve, stay stable, or deteriorate.

- Positive: Likely to improve.

- Stable: Expected to remain the same.

- Negative: Likely to worsen.

Think of outlooks like weather forecasts for insurance companies.

Additional Information

- Contact Number: For inquiries related to policies or financial details, you can reach Sagesure Insurance at 1-800-555-1234. This contact information ensures that you can get direct assistance from the company.

- Insurance Plans: Sagesure offers a variety of insurance plans, including homeowners, renters, and automobile insurance. Each plan is designed to provide comprehensive coverage tailored to different needs.

Why You Should Care About AM Best Ratings

A high AM Best rating assures you that your insurance company is financially stable and capable of handling claims. It’s like knowing your favorite bakery uses top-quality ingredients—you’re confident that you’ll get a great product.

Insurance companies with high ratings have demonstrated reliability and strong management practices. This builds trust and confidence, knowing that they’re less likely to face financial difficulties that could impact their ability to honor claims.

Choosing an insurer with a good rating can be crucial for long-term planning. It ensures that your insurance provider will be around to meet its obligations well into the future.

How to Research Insurance Companies

AM Best ratings are updated regularly. It’s a good idea to check the latest ratings before purchasing or renewing an insurance policy. This helps you stay informed about the financial health of your insurance provider.

Don’t settle for the first insurance company you come across. Compare ratings from different providers to find the one that best meets your needs. Think of it as shopping for a car—you want to make sure you’re getting the best value for your money.

In addition to AM Best ratings, look for customer reviews, complaint ratios, and other performance metrics. This provides a more comprehensive picture of the company’s overall reputation and service quality.

Conclusion

Navigating the world of insurance can be daunting, but understanding AM Best ratings simplifies the process. With a solid grasp of what these ratings mean and how they apply to companies like Sagesure Insurance, you’re better equipped to make informed decisions. Remember, a high rating signifies financial stability and reliability, crucial factors in choosing an insurance provider.

Final Tip: Always stay informed and don’t hesitate to ask questions. Just as you wouldn’t buy a car without checking its history, you shouldn’t choose an insurance company without understanding its financial stability.

And remember, in the world of insurance, it’s always better to be safe than sorry—because no one wants to find out their insurance company is like a bad joke: not funny when you need it the most.

Feel free to share this guide with others who might find it useful. If you have more questions or need personalized advice, don’t hesitate to contact Sagesure Insurance directly at 1-800-555-1234 or visit their official website.

Happy insuring!

Leave a Reply