Comprehensive Guide to Progressive Insurance in Watertown, WI

Welcome to the ultimate guide to Progressive Insurance in Watertown, WI! Whether you’re shopping for car insurance, home insurance, or just curious about what Progressive has to offer, you’ve come to the right place. We’ll break down everything you need to know in a way that’s easy to understand—no insurance jargon overload here. Think of this as your go-to resource for all things Progressive, complete with a dash of humor to make it more enjoyable. Let’s dive in!

What is Progressive Insurance?

Progressive Insurance is one of the largest insurance companies in the United States, known for its innovative approach to coverage. Established in 1937, Progressive started with a simple goal: to make insurance easier and more affordable for everyone. They offer a range of insurance products, including auto, home, renters, and more.

History of Progressive

Progressive was founded by Joseph Lewis and his wife, Grace, in Cleveland, Ohio. Since then, it has grown into a major player in the insurance industry. They are well-known for their commitment to providing customers with flexible, affordable insurance solutions. Remember when Flo made her TV debut? That’s Progressive’s mascot, adding a bit of charm to their brand!

Why Choose Progressive?

Progressive is famous for its customer-first approach and innovative tools. Here are some reasons why you might consider them for your insurance needs:

- Competitive Rates: Progressive often offers lower rates, especially if you bundle multiple policies.

- Discounts: From safe driver discounts to bundling discounts, they have options to save you money.

- Convenient Online Tools: Their website and app make managing your policies easy.

- Claims Process: Progressive has a reputation for a straightforward claims process.

How to Get a Quote from Progressive in Watertown, WI

Getting a quote from Progressive is simple and can be done online or over the phone. Here’s a step-by-step guide:

- Visit the Progressive Website: Go to the Progressive website and click on the “Get a Quote” button.

- Enter Your Information: Provide details about the type of insurance you’re looking for (auto, home, etc.).

- Customize Your Coverage: Choose the coverage options that best fit your needs.

- Review and Compare: Look over your quote and compare it with other offers if needed.

- Finalize Your Policy: If you’re happy with the quote, you can finalize your policy online.

- Call Progressive: Reach out to Progressive’s customer service at 1-800-PROGRESSIVE (1-800-776-4737).

- Provide Details: Give a representative the necessary information about yourself and the type of coverage you need.

- Receive Your Quote: The representative will provide you with a quote based on the details you’ve shared.

- Ask Questions: Feel free to ask any questions to ensure you understand your coverage options.

For a more personalized experience, you can visit or call a local Progressive agent in Watertown, WI. They can help you find the best coverage and answer any questions you may have. Simply search online for Progressive insurance agents in Watertown to find one near you.

Discounts and Savings with Progressive

Who doesn’t love a good discount? Progressive offers several ways to save on your insurance:

Bundling your auto, home, and other policies with Progressive can lead to significant savings. It’s like hitting the jackpot but for insurance!

Safe Driver Discount

If you have a clean driving record, you might qualify for a safe driver discount. It’s a great way to reward your responsible driving habits.

Multi-Car Discount

Insuring more than one vehicle with Progressive? You could be eligible for a multi-car discount. Just think of all the extra cash for road trips!

Good Student Discount

Students with good grades might qualify for a discount on their auto insurance. It’s a win-win—keep those grades up and save some money!

Homeowners Discount

If you own a home, Progressive might offer a discount on your auto insurance. It’s like a little thank you for being a responsible homeowner.

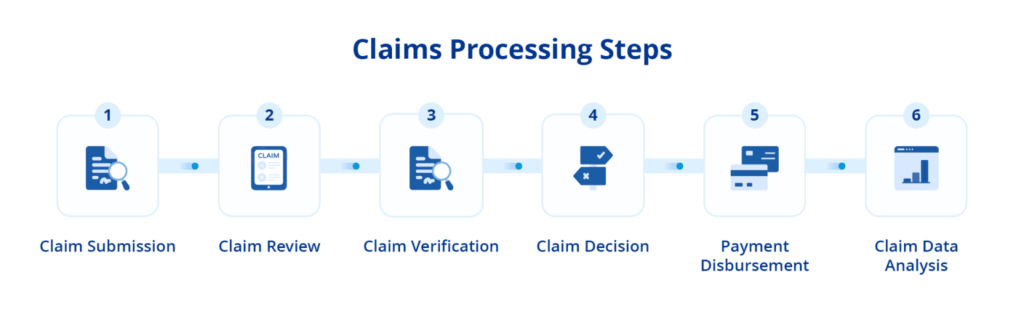

The Claims Process

Understanding how to file a claim can make a stressful situation much easier. Here’s how to do it with Progressive:

If you’ve been in an accident or experienced a loss, report the claim as soon as possible. You can do this through Progressive’s website, app, or by calling their claims department.

Provide Information

You’ll need to provide details about the incident, including any relevant documentation or evidence. This helps Progressive assess the situation accurately.

A claims adjuster will review your claim and determine the payout based on your coverage and the details provided. They’ll work with you to ensure everything is handled smoothly.

Once the claim is approved, you’ll receive compensation according to your policy terms. Progressive aims to handle claims efficiently so you can get back to normal as soon as possible.

Why Progressive Might Be the Right Choice for You

Choosing the right insurance company can be a bit overwhelming, but Progressive offers many advantages that might make it the right fit for you. From competitive rates and a wide range of coverage options to convenient online tools and discounts, they provide a comprehensive solution for your insurance needs.

If you’re in Watertown, WI, and looking for reliable insurance coverage with a company that values customer satisfaction, Progressive might be just what you need. Give them a try and see how they stack up against the competition.

Final Thoughts

In conclusion, Progressive Insurance offers a variety of coverage options and benefits that can help protect you, your home, and your vehicles. Their innovative approach, combined with excellent customer service and competitive rates, makes them a strong contender in the insurance market.

Whether you’re a car enthusiast,

Leave a Reply