Florida pip insurance

Florida’s Personal Injury Protection (PIP) insurance is a unique beast, much like a gator lounging in the sun—necessary, sometimes confusing, and often a little scary. So, what exactly is PIP insurance, and why should you care? Buckle up, because we’re about to dive into the world of Florida’s no-fault insurance system, where the only thing more complicated than the rules is figuring out how to pronounce “PIP” without sounding silly.

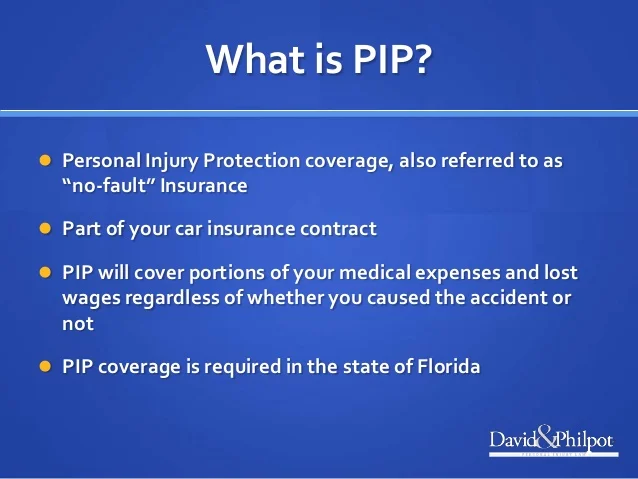

What is PIP Insurance?

PIP, or Personal Injury Protection, is a type of car insurance required in Florida. Think of it as your insurance superhero, swooping in to cover your medical expenses and lost wages after a car accident, regardless of who caused the crash. In Florida, every driver must carry a minimum of $10,000 in PIP coverage. Yes, even if you’re just driving to the beach to catch some rays, you need this coverage. It’s like wearing sunscreen—better safe than sorry!

What Does PIP Cover?

Now, let’s break down what PIP actually covers. It’s not a magic wand that makes all your problems disappear, but it does help with:

- Medical Expenses: PIP pays for 80% of your medical bills related to the accident, up to that $10,000 limit. This includes everything from hospital stays to physical therapy. Just remember, if you thought your spa day was “medically necessary,” PIP might not agree.

- Lost Wages: If you’re stuck at home recovering and missing work, PIP has your back for 60% of your lost income, again up to that $10,000 cap. So, if you were planning to take a trip to the Bahamas with that paycheck, you might need to rethink your vacation plans.

- Death Benefits: In the unfortunate event of a fatal accident, PIP will cover up to $5,000 for funeral expenses. It’s not a pleasant topic, but it’s good to know there’s a little help available during tough times.

The Catch: Deductibles and Limits

Before you start dreaming about how to spend your PIP money, there are some important caveats. First, you’ll have to pay a deductible before PIP kicks in. Think of it as your ticket to the insurance amusement park—no one likes paying it, but it’s necessary to get on the rides.

Also, PIP doesn’t cover everything. For instance, if you’re nursing a broken heart from your ex after the accident, don’t expect PIP to cover your therapy sessions. Emotional pain and suffering? Sorry, that’s not in the PIP playbook.

Why You Might Need More Than PIP

PIP is great for minor injuries, but if you find yourself needing more extensive medical treatment (like if you’ve turned into a human pretzel after the accident), you might want to consider pursuing additional compensation. Think of PIP as a first-aid kit—it’s handy for small scrapes, but if you’ve got a broken leg, you’ll need a bit more than a Band-Aid.

In Florida, if your medical bills exceed $10,000, or if you suffer a permanent injury, you can still file a personal injury lawsuit against the at-fault driver. So, if you find yourself in a situation where PIP just isn’t cutting it, don’t hesitate to call your friendly neighborhood attorney.

The 14-Day Rule

Here’s a fun little twist: Florida law requires you to seek medical treatment within 14 days of the accident to qualify for PIP benefits. So, if you think you can just walk it off like a tough guy, think again. Get checked out! Your body will thank you later, and so will your insurance.

Conclusion

In summary, Florida’s PIP insurance is like that quirky friend who’s always there for you but sometimes leaves you scratching your head. It covers a good chunk of your medical expenses and lost wages after an accident, but it has its limits. So, make sure you understand the ins and outs of your coverage, and don’t hesitate to seek additional help if needed. After all, navigating the world of insurance shouldn’t feel like wrestling an alligator—keep it simple, keep it smart, and you’ll be just fine!

Citations:

[1] https://www.thefloridalawgroup.com/news-resources/what-is-pip-coverage-in-florida-an-easy-to-understand-guide/

[2] https://farahandfarah.com/faqs/what-is-pip-insurance-florida/

[3] https://www.grammarly.com/article-writer

[4] https://www.bettercallchris.net/blog/2019/december/understanding-pip-insurance-coverage-in-florida/

[5] https://www.nerdwallet.com/article/insurance/pip-insurance-florida florida pip insurance

Leave a Reply