The Ultimate Guide to Personal Service Insurance: Everything You Need to Know

Introduction

Welcome to the world of personal service insurance! Whether you’re a freelancer, contractor, or small business owner, understanding personal service insurance is crucial for protecting your livelihood. In this comprehensive guide, we’ll cover everything you need to know about personal service insurance, from its importance to the different types available, and how to choose the right policy for your needs. We’ll also sprinkle in some humor and fun facts to keep things interesting. So, grab a cup of coffee, sit back, and let’s dive in!

What is Personal Service Insurance?

Personal service insurance is a type of insurance designed specifically for individuals and businesses that provide personal services. This can include a wide range of professions, such as consultants, freelancers, contractors, and small business owners. The primary goal of personal service insurance is to protect you from financial losses that may arise from various risks associated with your profession.

Why Do You Need Personal Service Insurance?

Imagine this: you’re a freelance graphic designer working on a big project for a client. Suddenly, your computer crashes, and you lose all your work. Without personal service insurance, you could be left footing the bill for a new computer and potentially losing out on future work from that client. Personal service insurance can help cover these unexpected expenses and keep your business running smoothly.

Types of Personal Service Insurance

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this type of insurance protects you from claims of negligence or mistakes in your professional services. For example, if a client claims that your advice led to financial loss, professional liability insurance can cover legal fees and damages.

- General Liability Insurance: This insurance covers third-party claims for bodily injury, property damage, and personal injury. For instance, if a client slips and falls in your office, general liability insurance can cover medical expenses and legal fees.

- Business Owner’s Policy (BOP): A BOP combines general liability insurance with property insurance, providing comprehensive coverage for small business owners. This policy can cover everything from property damage to business interruption.

- Cyber Liability Insurance: In today’s digital age, cyber threats are a significant concern for businesses. Cyber liability insurance protects you from data breaches, cyberattacks, and other online risks.

- Workers’ Compensation Insurance: If you have employees, workers’ compensation insurance is essential. It covers medical expenses and lost wages for employees who are injured on the job.

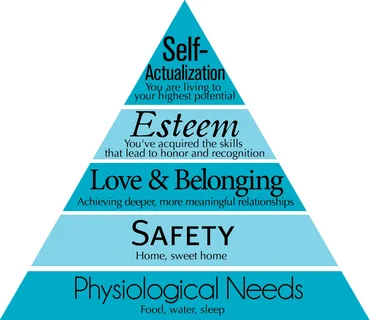

How to Choose the Right Personal Service Insurance

Choosing the right personal service insurance can be overwhelming, but it doesn’t have to be. Here are some tips to help you make an informed decision:

- Assess Your Risks: Start by identifying the specific risks associated with your profession. This will help you determine which types of insurance are most relevant to your needs.

- Compare Policies: Don’t settle for the first policy you come across. Take the time to compare different policies from various insurers to find the best coverage at the most affordable price.

- Read the Fine Print: Make sure you understand the terms and conditions of the policy, including any exclusions or limitations. This will help you avoid surprises down the road.

- Consult an Insurance Agent: If you’re unsure about which policy to choose, consider consulting an insurance agent. They can provide expert advice and help you find the right coverage for your needs.

Common Misconceptions About Personal Service Insurance

- “I Don’t Need Insurance Because I’m a Small Business”: Even small businesses face risks that can lead to significant financial losses. Personal service insurance is essential for protecting your business, regardless of its size.

- “Insurance is Too Expensive”: While insurance premiums can be costly, the financial protection they provide is well worth the investment. Plus, there are ways to save on insurance, such as bundling policies or increasing your deductible.

- “I Don’t Need Cyber Liability Insurance”: Cyber threats are a growing concern for businesses of all sizes. Cyber liability insurance can protect you from the financial fallout of a data breach or cyberattack.

Funny Insurance Facts

- Alien Abduction Insurance: Believe it or not, some companies offer insurance policies that cover alien abductions. While it may sound far-fetched, these policies have actually been purchased by thousands of people!

- Body Part Insurance: Celebrities and athletes often insure their body parts for millions of dollars. For example, soccer star David Beckham has insured his legs for $70 million!

- Wedding Insurance: Planning a wedding can be stressful, but did you know you can buy insurance to cover unexpected events like a vendor no-show or extreme weather? Wedding insurance can help ensure your big day goes off without a hitch.

Conclusion

Personal service insurance is a vital tool for protecting your business and ensuring its long-term success. By understanding the different types of insurance available and choosing the right policy for your needs, you can safeguard your livelihood and focus on what you do best. Remember to assess your risks, compare policies, and consult an insurance agent if needed. And don’t forget to have a little fun along the way – after all, insurance doesn’t have to be boring!

For more information on personal service insurance, check out AXA’s guide on personal service companies and Contractor UK’s comprehensive article.

If you have any questions or need further assistance, feel free to reach out to an insurance professional. Happy insuring!

Leave a Reply