How Much Does Car Insurance Cost in Costa Rica?

When considering a move to Costa Rica or planning an extended stay, one of the essential things to understand is the cost of car insurance. This guide will provide you with a comprehensive overview of car insurance costs in Costa Rica, covering everything from mandatory requirements to optional coverages, and factors that influence the price. Let’s dive in!

Mandatory Car Insurance in Costa Rica

In Costa Rica, car insurance is not just a good idea—it’s the law. The government mandates that all vehicles must have a minimum level of liability insurance, known as Obligatory Insurance for Motor Vehicles (SOA). This insurance covers third-party liability, ensuring that if you cause an accident, the injured party’s medical expenses and property damage are covered1.

External Link: For more details on the mandatory insurance requirements, you can visit the Instituto Nacional de Seguros (INS) website.

Average Costs of Car Insurance

The cost of car insurance in Costa Rica can vary widely based on several factors, including the type of vehicle, the driver’s age and driving record, and the chosen coverage options. On average, you can expect to pay between $500 to $1,500 per year for car insurance2.

External Link: To compare quotes from different insurance providers, check out Car Jokers.

Factors Influencing Car Insurance Costs

Several factors can influence the cost of car insurance in Costa Rica:

- Type of Vehicle: Luxury cars and SUVs typically cost more to insure than smaller, economy cars.

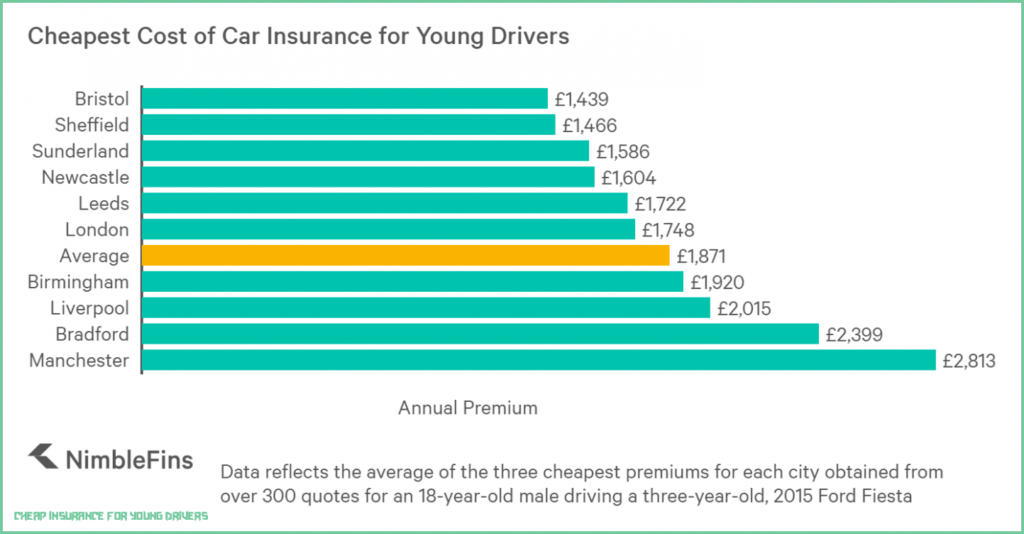

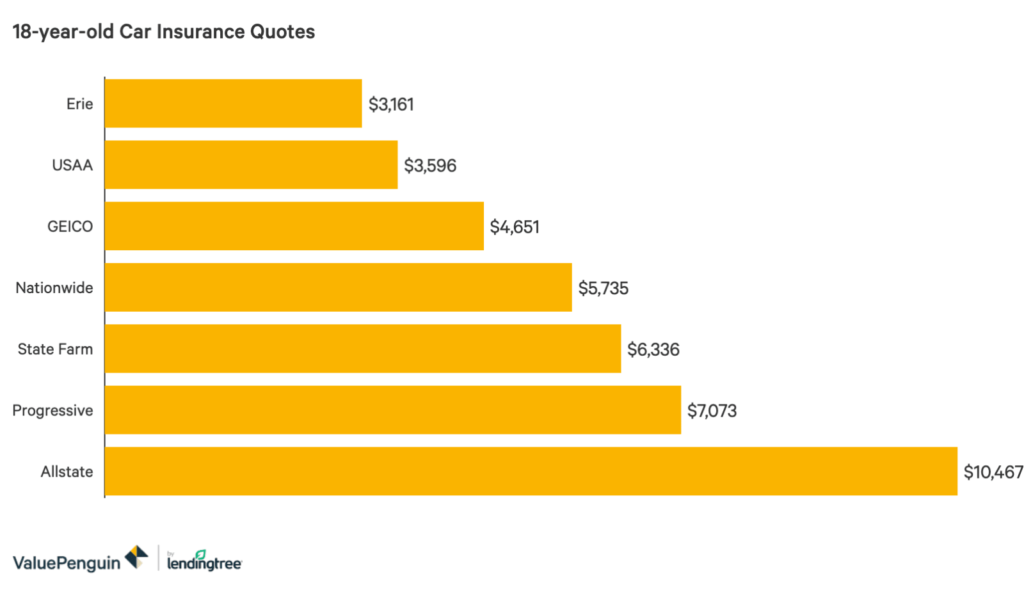

- Driver’s Age and Gender: Younger drivers and males often face higher premiums.

- Driving Record: A clean driving record can help lower your insurance costs.

- Location: Insurance costs can vary depending on where you live in Costa Rica. For example, premiums might be higher in urban areas like San José compared to rural regions3.

External Link: For a detailed breakdown of how these factors affect insurance costs, visit Vtalk Insurance.

Optional Coverages

In addition to the mandatory SOA, many drivers opt for additional coverages to protect themselves further. These include:

- Collision Damage Waiver (CDW): Covers damages to your vehicle in the event of an accident.

- Comprehensive Insurance: Provides coverage for non-collision-related damages, such as theft or natural disasters.

- Zero Liability Insurance: Reduces your liability to zero when combined with other coverages1.

External Link: Learn more about optional coverages at Costa Rica Guide.

How to Save on Car Insurance

Here are some tips to help you save on car insurance in Costa Rica:

- Shop Around: Compare quotes from multiple insurance providers to find the best deal.

- Bundle Policies: If you have other types of insurance (like home or health insurance), see if you can bundle them for a discount.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your premiums low.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premiums, but be sure you can afford the out-of-pocket cost in case of an accident.

External Link: For more tips on saving money on car insurance, visit Angloinfo.

Making a Claim

In the unfortunate event that you need to make a claim, it’s essential to know the process. In Costa Rica, the INS provides a number to call in case of an accident. They will guide you through the necessary steps to file your claim4.

External Link: For detailed instructions on making a claim, visit the INS website.

Conclusion

Understanding the cost of car insurance in Costa Rica and the factors that influence it can help you make informed decisions and potentially save money. Whether you’re a resident or a long-term visitor, having the right insurance coverage is crucial for your peace of mind and financial security.

External Link: For more comprehensive information on car insurance in Costa Rica, check out Costa Rica Cars.

I hope this article helps you navigate the complexities of car insurance in Costa Rica. If you have any specific questions or need further assistance, feel free to ask!

Leave a Reply