Malpractice insurance for social workers

Social workers play a crucial role in society, providing support and services to individuals and communities in need. However, like any profession, social work comes with its risks. One of the most significant risks is the potential for malpractice claims. This is where malpractice insurance, also known as professional liability insurance, becomes essential. In this comprehensive guide, we’ll explore everything you need to know about malpractice insurance for social workers, including why it’s important, what it covers, and how to choose the right policy.

Why Malpractice Insurance is Essential for Social Workers

Social workers often deal with sensitive and complex issues, ranging from mental health to child welfare. Despite their best efforts, mistakes can happen, and clients may feel wronged or harmed. Malpractice insurance provides a safety net, protecting social workers from financial ruin in the event of a lawsuit. Without this coverage, social workers could face significant legal fees and damages, even if the claim is unfounded1.

What Does Malpractice Insurance Cover?

Malpractice insurance typically covers the following:

- Legal Defense Costs: This includes attorney fees, court costs, and other legal expenses incurred while defending against a malpractice claim.

- Settlements and Judgments: If a social worker is found liable, the insurance will cover the cost of settlements or judgments up to the policy limit.

- Licensing Board Defense: Coverage for legal representation in front of licensing boards if a complaint is filed against the social worker.

- Personal Injury: This can include claims of libel, slander, or invasion of privacy2.

Types of Malpractice Insurance Policies

There are two main types of malpractice insurance policies:

- Claims-Made Policies: These policies provide coverage only if the claim is made while the policy is active. If the policy lapses, so does the coverage.

- Occurrence Policies: These policies cover incidents that occur during the policy period, regardless of when the claim is made. This type of policy offers more comprehensive protection but is usually more expensive3.

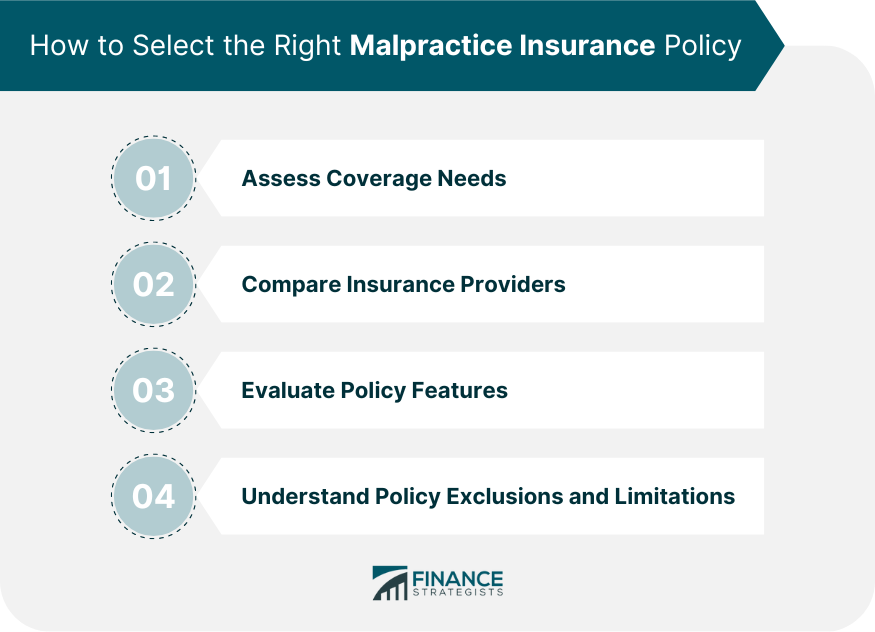

Choosing the Right Malpractice Insurance Policy

When selecting a malpractice insurance policy, consider the following factors:

- Coverage Limits: Ensure the policy provides adequate coverage for potential claims. Higher limits offer more protection but come with higher premiums.

- Deductibles: Check the deductible amount, which is the out-of-pocket cost before the insurance kicks in. Lower deductibles mean higher premiums and vice versa.

- Exclusions: Understand what is not covered by the policy. Common exclusions include criminal acts, intentional harm, and certain types of claims.

- Additional Coverage Options: Some policies offer additional coverage, such as cyber liability or business interruption insurance4.

How to Purchase Malpractice Insurance

Purchasing malpractice insurance can be done through various channels:

- Professional Associations: Many social work associations offer group malpractice insurance plans at discounted rates. For example, the National Association of Social Workers (NASW) provides comprehensive coverage options for its members5.

- Insurance Brokers: Working with an insurance broker can help you find the best policy tailored to your needs. Brokers have access to multiple insurance providers and can compare policies on your behalf.

- Direct Purchase: Some insurance companies allow you to purchase policies directly from their websites. This can be a convenient option but may not always offer the best rates.

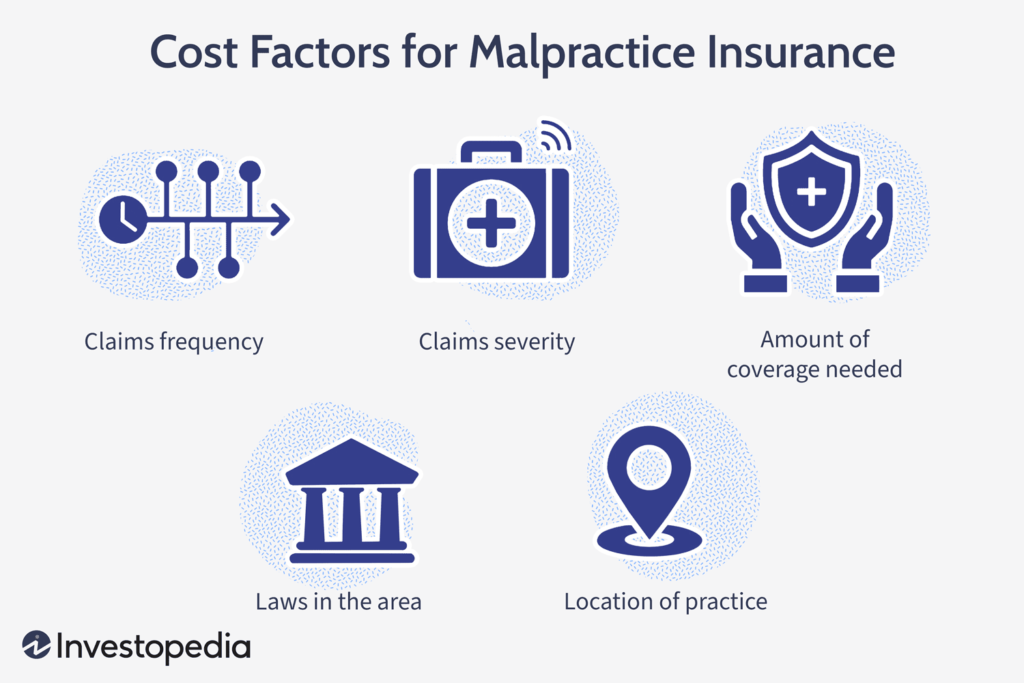

The Cost of Malpractice Insurance

The cost of malpractice insurance varies based on several factors, including:

- Experience Level: More experienced social workers may pay higher premiums due to increased risk exposure.

- Location: Insurance costs can vary significantly by state or region.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles result in higher premiums.

- Claims History: Social workers with a history of claims may face higher premiums.

Common Misconceptions About Malpractice Insurance

There are several misconceptions about malpractice insurance that need to be addressed:

- “I Don’t Need Insurance Because I’m Careful”: Even the most diligent social workers can face claims. Malpractice insurance is about protecting against the unexpected.

- “My Employer’s Insurance Covers Me”: Employer-provided insurance may not cover all situations, especially if you work as an independent contractor or have a private practice.

- “It’s Too Expensive”: The cost of malpractice insurance is relatively low compared to the potential financial impact of a lawsuit.

Conclusion

Malpractice insurance is a vital safeguard for social workers, providing financial protection and peace of mind. By understanding the different types of policies, coverage options, and factors affecting cost, social workers can make informed decisions to protect their careers and livelihoods. Don’t wait until it’s too late—invest in malpractice insurance today and ensure you’re covered against the unexpected.

For more information on malpractice insurance for social workers, visit the National Association of Social Workers or HelloPolaris.

1: BASW Insurance Cover 2: HelloPolaris 3: NASW Liability Insurance 4: NACSW Professional Liability Insurance 5: Insureon Social Worker Insurance : NASW Liability Insurance : HelloPolaris : BASW Insurance Cover

I hope this article helps you understand the importance and details of malpractice insurance for social workers. If you have any specific questions or need further assistance, feel free to ask!

Leave a Reply